Gold – no counterparty risk!

The banks are collapsing – would it be about time to realize that gold has no counterparty risk? If you don’t trust the bankers – read this article – it was already published in December.

Peter Hanseler

This essay seeks to show that in today’s world of turbulence, gold does have the potential to become again what it has been for millennia – the queen of value preservation. This is justified in particular by one of the many peculiarities of this precious metal: gold as the only true money and the importance of this property to all of us.

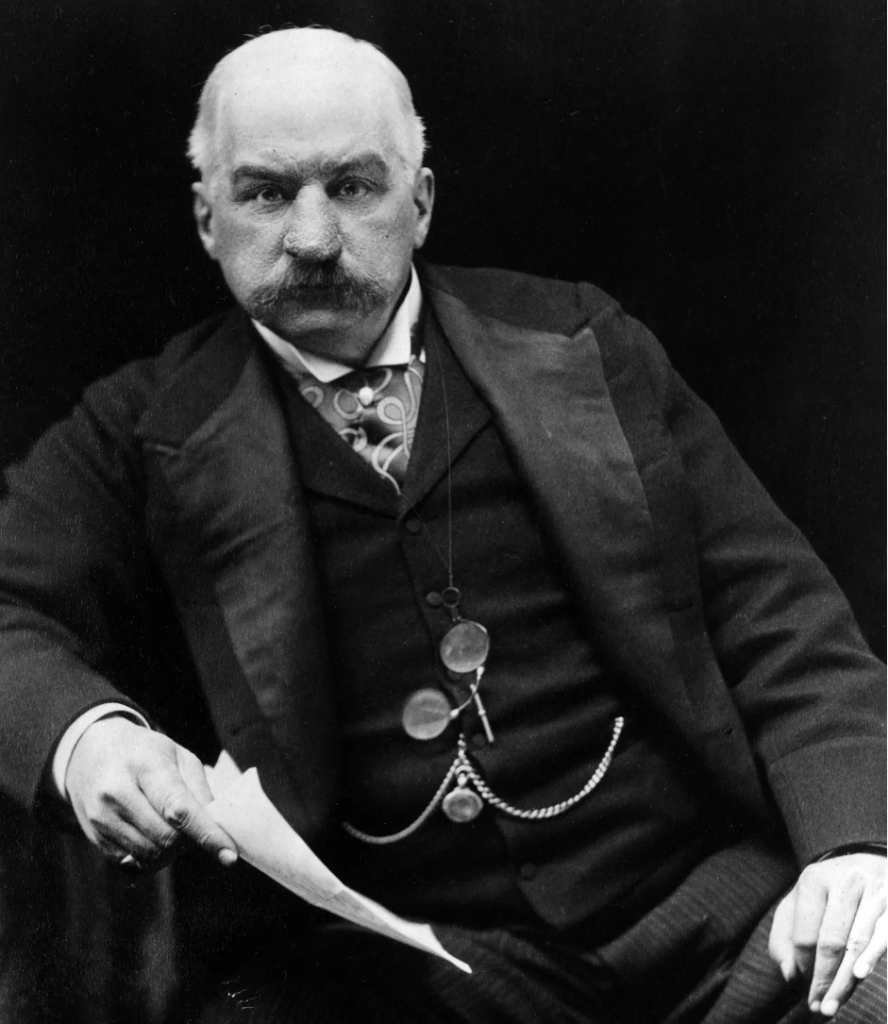

At a US Congressional hearing in 1912, John Pierpont Morgan – arguably the most powerful banker of his time – said the following about gold:

“Gold is money, everything else is credit.”

J.P. Morgan

Counterparty risk

Introduction

To understand the greatest advantage of gold over almost all other assets, one must understand the systematics of “counterparty risk”. This is much simpler than one might think. The chain of counterparty risk runs from the craftsman to Central Banks.

Financial losses and debacles always have the same cause: in a business transaction, the losing party has misjudged its counterpart and thus misjudged the business risk.

Craftsman

A housepainter paints a customer’s flat and is stuck with the unpaid bill. He has misjudged the customer’s willingness to pay as a counterparty.

Credit risks of the banks

In March 2021, Credit Suisse lost five billion because it had granted a massive loan to the American “Archegos” fund, which then squandered the money. The bank had misjudged the risk and the money went down the drain.

Bank client

The counterparty of the investor is the bank. Although most bank clients refer to their account as “their” money, this is wrong. The money is the property of the bank.

This is because ownership of the deposited money passes to the bank and all that remains to the client is a contractual claim that obliges the bank to return the money to the client.

The bank also has no obligation to keep the entire amount of the deposit safe, but only 10% of it; this is regulated by law. It can play with the remaining 90%: Grant loans, invest without telling the client what it is doing with the money – it can do that because the money no longer belongs to the client. In return, the client receives an interest rate that regularly does not even compensate for inflation. A pathetic deal for the client, who gets nothing and risks everything.

To put it simply, this goes well until more than 10% of the customers simultaneously assert their claim and demand the money back. If this happens, it is called a “bank run” and the bank goes bust.

Should this happen, the clients have misjudged the risk and the money is gone. Aware of this risk, many countries have a system in which a certain amount is guaranteed by the state. In Switzerland, this amount is CHF 100,000 per client.

Cash

If you hold your assets in cash, i.e. in banknotes, your counterparty is not a normal bank but the respective central bank, thus the SNB is responsible for the Swiss franc.

A central bank cannot go bankrupt because it can print unlimited amounts of money, so it is theoretically impossible for a banknote holder to lose everything. I use the word “theoretically” because it is quite possible in practice and has already happened.

The best known example of this is the German Reichsmark, which completely lost its value in 1923 in the so-called Weimar hyperinflation. On 1 November 1923, a banknote of 5 trillion Reichsmarks, that is 5,000 billion (5,000,000,000,000.-) had the same purchasing power as a 50 Mark note anno 1914. How could this happen?

“The Swiss National Bank (SNB) is also anything but a hero in maintaining the value of the Swiss franc”

With the outbreak of the First World War, Germany suspended the gold standard, i.e. until then the paper money issued by the Reichsbank was backed by its gold reserves. The decision was made to decouple the Reichsmark from gold in order to be free to print money for war spending. This was the beginning of the end and more and more money was printed, leading to the collapse of the Reichsmark five years after the end of the First World War.

The Swiss National Bank (SNB) is also anything but a hero in maintaining the value of the Swiss franc, although it does it better than any other central bank in the world. For more on this, I refer you to my article on the SNB.

It is not at all difficult to prove that the SNB does not deserve hero status in value preservation.

Cash compared to gold

Let us take a typical Swiss example: In 1949, a girl receives a 20-franc gold coin called the Vreneli from one grandfather and a 20-franc bank note from the other grandfather for Christmas. Both are worth CHF 20.

Delighted about the big presents, the child puts the banknote and the Vreneli into her piggy bank and lets it save.

If the girl who has become a grandmother only slaughters her piggy bank today, the 20-note note still has a value of CHF 20, but the gold Vreneli has a value of about CHF 350. From the point of view of gold, the Vreneli has not increased in value, but the franc has lost 95% of its value.

The counterparty risk in holding cash is therefore that the central bank does not protect the value of the money, but prints too much money.

Counterparty risk among central banks

The last link in this chain of risks is the central banks themselves and one of them, the Russian central bank, realised this year that even central banks are exposed to counterparty risks.

Western countries, led by the US, EU and also Switzerland, blocked the Russian Central Bank’s foreign currency reserves to the tune of about CHF 300 billion. Since Russia has no net debt and invests a considerable part of its reserves in gold, this sanction did not have the desired effect, but another much more far-reaching one; more on this below.

Interim result

The biggest advantage of physically held gold now is that it is not exposed to the counterparty risks described. The only risk a person has if they hold gold physically is theft. Scrooge Duck can tell you a thing or two about it.

The quote by J.P. Morgan, “Gold is money, everything else is credit”, is thus a very wise phrase; you just have to understand it.

Paper money – nowadays more common electronic money – is thus fraught with risks of which most people are not aware. If your grandfather asks you whether you would prefer cash or gold, this question is now very easy to answer.

Bogus arguments against gold

Most bankers, investors, central banks and governments use bogus arguments against gold. On closer inspection, however, these are sham arguments.

This argument is not an argument against gold, but in favour of it. Gold is money and money – as long as it is held in cash – does not yield interest. Interest is only paid on money when it is invested, i.e. when it is brought to the bank. But then the counterparty risk already described comes to life.

Gold is a bad investment

This is the bankers’ favourite argument, but it is not only nonsensical, it is also wrong.

Nonsensical because physical gold is not an investment, but money. And false because the figures speak for themselves.

For comparison, let’s pit the world’s largest stock index, the American S&P 500, which tracks the 500 largest listed US companies, against gold.

We look at the performance over two periods: The first period is supposed to be a long one, from 1 January 2000 to today, 13 December 2022. The second period is supposed to be a short one, the current year 2022.

Performance S&P 500 (link) if all dividends of the shares are reinvested

Period 1.1.2000 – 13.12. 2022: 303%, i.e. USD 100 has become USD 303.

Period 1.1.2022 – 13.12.2022: -17%, i.e. USD 100 has become USD 83.40.

The bank’s costs and fees must be deducted from this performance: If we set these at 1% per year, the bank would have siphoned off about USD 50 from the USD 303 during the 22 years.

Performance Gold (link) (no dividend)

Period 1.1.2000 – 13.12. 2022: 441%, i.e. USD 100 would have become USD 441.

Period 1.1.2022 – 13.12.2022: -1.7%, i.e. USD 100 would have become USD 98.30.

Thus the most popular argument against gold is refuted.

“The grandmother who keeps her savings in gold thus beat the banker hands down”

Bankers

Bankers have every reason to lie; no one should be surprised by this and the reasons are as obvious as they are mundane. When you buy physical gold, the banker earns nothing.

The interest of a bank is to make money – the interest of the customer is secondary. If banks thought about their customers, they would compete with each other on the performance of customer deposits and thus advertise their own performance. Have you ever seen a bank that advertises with the performance of their client portfolios?

Western central banks

Western central banks hate gold. And they have since 1971 when President Nixon abolished the gold standard. I have already written about this several times in the articles on the death of the petrodollar, the unstoppable rise of the East and the Swiss National Bank.

Gold is hated because its value most easily demonstrates the destruction of our paper currencies. Since 1971, the US dollar has lost 98% against gold, the Swiss franc “only” 90%.

Interim result

Holding gold instead of investing in shares, for example, therefore has great advantages: Gold retains its value and is not exposed to any counterparty or market risk, because gold does not fluctuate. But everything around gold goes up and down and everyone wants to buy low and sell high, with very mixed success.

The grandmother who holds her savings in gold thus beat the banker hands down, not only in the last 22 years, but also in a difficult year like 2022.

To “save the honour” of the bankers: I know several relationship managers who hold virtually only gold in their personal assets. However, they are not allowed to advise their clients to do so, because otherwise they would lose their jobs within a very short time, since the bank would then earn nothing or much less. This is one of the great conflicts of interest inherent in the banking business.

Central banks and private individuals buy a lot of gold

The look into the future starts in the present. This year, central banks have never bought so much gold as they have since 1967.

Private individuals are also buying more physical gold than they have in a long time.

There are many reasons for this. Some of them will be discussed.

Central banks protect themselves from inflation

The huge gold purchases by central banks are on the one hand a consequence of the irresponsible behaviour of major central banks. Since 2008, the Fed, the ECB and the Japanese central bank have been printing money that takes one’s breath away; this leads to a great devaluation of these currencies. By buying gold, the buying central banks protect themselves from this danger; see my comments in the articles on BRICS, on the Petrodollar and the SNB for more details.

Central banks around BRICS turn away from the US dollar

In the past, the world’s central banks bought US government bonds because they held their reserves in US dollars, since all commodities were settled in this currency and the economy thus needed US dollars. For some time now, however, there has been a tendency for many countries around the BRICS organisation to want to separate from the US dollar, to do their business in their own currencies and thus to hold more gold again.

Central banks around BRICS fear expropriation

In addition, the central banks are also exposed to the counterparty risk mentioned. With a stroke of the pen – decided by a few politicians – Russia’s foreign currency reserves were frozen because of its military intervention in Ukraine.

“The Chinese, who hold over 3,480 billion US dollars in reserves, were shocked”.

This worked without any problems because, for example, the US dollar reserves of the Russian Central Bank are not in Russia, but at the central bank FED in Washington. This works the same way as when a bank customer holds a USD account at his bank in Switzerland: The money is in the USA and the Swiss bank only has a claim on the US dollars. A central bank holding foreign currencies is therefore just as much at risk vis-à-vis the other central banks as the bank customer described. Politicians have exploited this circumstance and robbed the Russian central bank of its funds.

The Chinese, who hold over 3,480 billion US dollars in reserves, were shocked by the West’s action against Russia. They must be wondering if the same thing will happen to them. If you follow the Western media, you can see that the negative propaganda is increasingly turning against the Chinese as well, after eight years of focusing on the Russians.

Now the Western politicians – with the expert help of their media – only have to raise the outrage against China a few notches higher and then the Chinese can also have their foreign currency reserves frozen.

The Chinese have been buying gold for decades to escape from the US dollar and its devaluation. Since this year, they have been further motivated by the freeze on Russian foreign currency reserves. They probably bought the most in 2022 as well.

Private buyers

Private investors are also buying more and more gold as they realise that something is wrong in the financial markets. Germans hold the most gold per capita – the Weimar hyperinflation is probably still in the guts of Germans even after 100 years.

In recent years, however, the Swiss are the world’s biggest gold buyers per capita.

The babble of the central bankers

Stocks are overvalued, real estate is overvalued, bonds are overvalued, inflation is raging on a scale seldom seen and the central bankers’ babble is untrustworthy: when inflation started – well before the Ukraine war – Jerome Powell, president of the US Federal Reserve, and Christine Lagarde, president of the ECB, for example, claimed that inflation was temporary. That was inaccurate. Incidentally, this was not an isolated case; the central bankers of the West are traditionally among the lousiest forecasters in matters of money and the economy. The fact that they are still believed is beyond me.

So why isn’t the gold price moving?

Although gold has left all other asset classes behind in 2022 and central banks and private individuals are buying a lot of gold, it has not risen in most major currencies so far this year.

“This makes about as much sense as if the price of bread were determined by the price of the paper wrapper where the bread is inside”

But according to the law of supply and demand, the price of gold should have risen sharply – what’s wrong with that?

The problem is that the gold price is not determined in the physical market, but by the LBMA in London and the Comex in New York. No physical gold is traded on these markets, but so-called paper gold; these are exchanges that trade derivatives, which are backed by only about 1% physical gold.

This makes about as much sense as if the price of bread were determined by the price of the paper wrapper where the bread is inside. This is not a flaw in the system, it is intentional.

Since 1971, central banks have been trying to keep the price of gold low – I have already discussed this. There are even telephone transcripts of President Nixon’s conversations with his Secretary of State Kissinger in the autumn of 1971 that prove this.

Although the price of gold in US dollars has risen since 1971 from USD 35 to about USD 1,800 today, attempts have been made for 50 years to depress the price of gold through market manipulation.

From conspiracy theory to reality

Until recently, accusations of market manipulation were relegated to the world of conspiracy theories. But then the biggest player in these markets, the American bank J.P. Morgan Chase, was fined USD 920 million two years ago for market manipulation in the precious metals market.

“Of course, this had no further consequences for the gentlemen at the carpet levels of this criminal bank”

This bank was proven to have manipulated the market through “spoofing”. Spoofing describes the activity of falsely making the market believe that one is going to make huge purchases or sales in order to encourage the other market participants to buy or sell, which pushes the price up or down. However, these purchases or sales by the spoofers are withdrawn at the last moment and the spoofer subsequently buys or sells a position before the market realises that it has been taken to the cleaners. The other market participants foot the bill.

Experts explain that the USD 920 million fine was a trifle compared to the amounts that JP Morgen had earned through this scam.

Of course, this had no further consequences for the gentlemen at the carpet levels of this criminal bank.

Outlook

If one looks at the advantages of gold and is aware of the fact that the western central banks manipulate the gold price downwards, but the rest of the world buys more and more gold and turns its back on the US dollar, gold as an investment is already very attractive from this perspective.

The market turmoil in almost all other asset classes such as equities, bonds, real estate and cryptocurrencies is also in favour of gold.

“You should be more afraid of the banks than the tank crackers”

We have learned why the banks do not give this advice.

This article is not a recommendation to buy, but an appeal to common sense.

If you decide to buy, buy physical gold and keep it in a safe, not at a bank, but at a gold dealer or at home and not all in the same place. Banks will offer you gold accounts, ETFs and other products. These have one thing in common: they are expensive and have counterparty risk.

One should be more afraid of the banks than of the tank crackers.

One thought on “Gold – no counterparty risk!”