The unstoppable rise of the East

If you believe the Western politicians and media, three topics are currently important in our world: Putin, energy and inflation. But if you take the trouble to look beyond the western horizon, you will see developments that have the potential to change the world more permanently than all the military conflicts of the last hundred years put together.

Peter Hanseler

The omnipresent conflicts between Russia and the West, the consequences of a European energy policy that has been moving in a bandwidth of misdirection for years, and the irresponsible monetary policy of Western states, central banks, banks and the disastrous actions of consumers, serve as catalysts for a long-awaited change in the East, the change to a multipolar world, i.e. a world that is free of hegemony, a hegemony that is currently being enforced by the USA above all with the US dollar, or rather petrodollar.

An overall view is not possible within the framework of this essay. This text is merely intended to encourage readers to look to the East in order to realise that the hegemony of the West is coming to an end.

Reserve currencies and hegemony

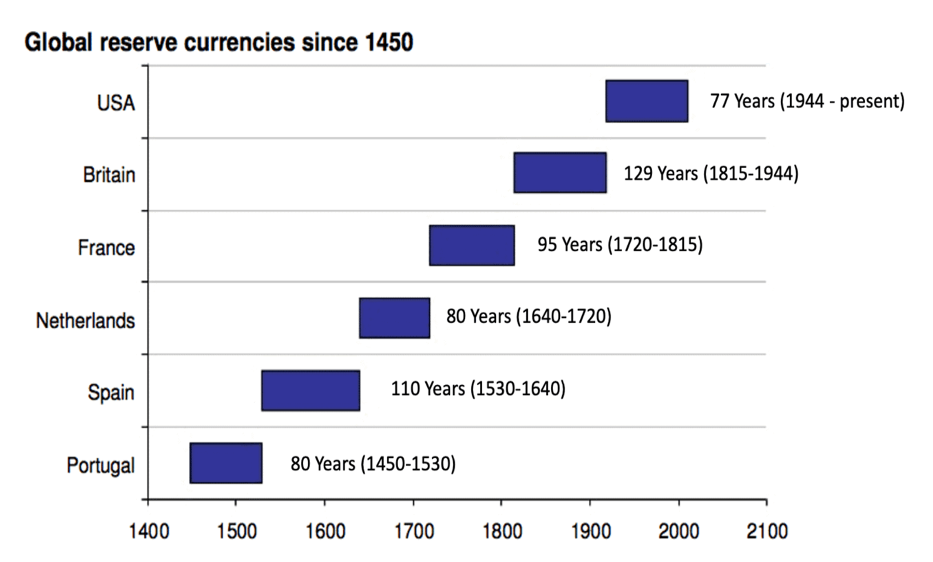

The countries that have provided the global reserve currency for the last 600 years or so have been the Western empires of their time: Portugal, Spain, the Netherlands, France, Great Britain and now the USA.

All of these countries sought hegemony: Britain and the US largely succeeded, nota bene at the expense of the rest of the world.

“Queen Elizabeth II had a box seat during her long reign from which she could observe the decline of the British Empire.”

The US’s predecessors as hegemons did not perish on the battlefields of this world; rather, they went broke because they regularly abused their exorbitant reserve currency privilege – see my article on the petrodollar.

The British, for example, won both world wars of the last century alongside their allies: World War I still as a world power, World War II merely as a junior partner of the USA. However, these victories in the war did not help the giant empire of Great Britain to stop its decline. The British pound, for example, fell by 90% against the Swiss franc in the last 50 years and the recently passed Queen Elizabeth II had a box seat during her long reign from which she could observe the decline of the British Empire.

Bretton Woods I

The present and probably last hegemon took over the sceptre in 1944 – when the victory of the Allies in the Second World War was becoming apparent. Due to its great military, economic and industrial power, the USA managed to force the world into a financial corset that bore the name of the conference venue in New Hampshire: Bretton Woods. Under this monetary order, the US dollar was at the centre of 43 other currencies that were in a fixed exchange rate relationship with each other; only the US dollar was backed by gold, at an exchange rate of USD 35 per ounce.

Bretton Woods II

In 1971, President Nixon ended the gold standard after only 27 years by abolishing the convertibility of the US dollar to gold, thus removing the foundation of the Bretton Woods system. The reason for this abrupt decision was mundane: The USA had abused its exorbitant privilege by printing too many US dollars. Members – above all the French – noticed this already at the beginning of the 1960s and exchanged their US dollars for gold at 35 dollars per ounce. Within a short time, this led to the US gold hoard melting down from over 20,000 tonnes to just over 8,000 tonnes.

The period after 1971 can be called Bretton Woods II or the time of the King Dollar.

The creation of the petrodollar in 1974 by the now highly controversial but certainly ingenious Secretary of State Kissinger led to practically all commodities in the world being settled in US dollars. This maintained the hegemony of the USA to this day.

“40% of all the US dollars in the world have been printed in the last 2 years. The other 60% took over 240 years to create.”

Since 1971, currencies have been backed by nothing; they degenerated into so-called fiat currencies. Now the countries were free to print as much money as they thought necessary to cover their budgetary requirements. No measure or yardstick applied any more; only the lack of a sense of proportion on the part of central banks and politicians served as a guide.

This led to an unprecedented increase in the money supply, an increase that is accelerating exponentially. As an example: 40% of all the US dollars in the world have been printed in the last 2 years. The other 60% took over 240 years to create.

Since 1971, America has gone from being the largest creditor nation to the largest debtor nation on earth in just a few decades.

Despite this disastrous policy of debasing money, the West still believes today that it is able to rule the world. The West still controls the IMF, the World Bank, nations like France still sit on the UN Security Council, as if the world had not changed since 1945. An old braid rules the world, much to the displeasure of the rest.

The G7 combines 777 million people. The other 7 billion people see themselves economically dominated by 10% of the world’s population. The US share of the world’s GDP, for example, has declined by about 30% since the 1980s, while China’s share of the world’s GDP has risen by 50% in the same period.

The East – and this word should not be understood geographically, but rather politically – is reorganising itself and standing ever closer together. This is happening bilaterally, but also in organisations which, fatally, are only perceived as a passing note in the West.

From BRIC to BRICS to BRICS+

In 2006, four countries – Brazil, Russia, India and China – the BRIC countries – met for the first time on the fringes of the UN General Assembly in New York. A first formal meeting took place in Yekatarinenburg in 2009. The aim of this initially loose community was to improve cooperation between these countries. In 2010, South Africa joined, which means that this organisation has since been called BRICS.

These are five countries with a population of around 3.2 billion people. This year, Argentina and Iran began the admission process. Algeria, the United Arab Emirates, Kazakhstan, Indonesia, Senegal, Mexico, Nigeria, Pakistan, Saudi Arabia, Sudan, Syria, Turkey and Venezuela have already expressed interest in joining in the near future.

Whether these accessions are already prepared in the background to the extent that sometime in the near future a BRICS+ giant will stand before the sun of the West with a bang is quite conceivable. There are two indications of this: firstly, the East is more discreet than Mr. Justin Trudeau, for example, and secondly, there is an almost pathological disinterest in the West towards this organisation.

Another organisation is the SCO, the Shanghai Cooperation Organisation. It is the world’s largest regional organisation, covering about 40% of the world’s population and 30% of the world’s gross national product.

So far, China, Kazakhstan, Kyrgyzstan, Russia and Uzbekistan are members. India, Pakistan, Mongolia and Iran have observer status and another 10 states, including Saudi Arabia, are so-called dialogue partners.

What both organisations have in common is that their aim is not to become a political entity, as has happened – sadly – with the EU. Rather, these organisations aim to become more independent from the Western corset, with the clear understanding that they should remain as independent as possible from each other.

Among the members – for example China and India or Pakistan – there are considerable bilateral conflicts. Nevertheless, it seems that despite these considerable differences among themselves, the member countries are submitting to the larger goals of these organisations: Ending Western hegemony.

The storm of sanctions – since Trump against China and since 2014 and 2022 against Russia – encourages these countries to stand even closer together and become independent.

Western sanctions as an accelerator

Two decisions by the West have led to an acceleration in the efforts of these groups of countries to free themselves from the Western yoke, without the West seeming to be aware of it.

The West’s decisions to ban Russia from SWIFT and to freeze its foreign currency reserves in order to change Russia’s policy towards Ukraine were ludicrously wrong decisions in several respects.

First, the West fails to recognise that the countries sanctioning Russia represent only 15% of the world’s population. Thus, most of the world is not ready to stand up to Russia. This has nothing to do with whether these countries approve of Russia’s military intervention or not, many do not. However, these countries represent their own interests. These interests are clearly put before the ideology of the West by the proponents.

It is surprising and not a sign of diplomatic professionalism that the West was not aware of this fact. One was perplexed, for example, in March when India announced not only that it would not impose sanctions on Russia, but that it had multiplied its foreign trade with Russia since the West began imposing sanctions.

Secondly, this Western two-pronged attack on Russia showed the East that the West is not to be trusted. If the West does this to the Russians, the Chinese also see themselves as potential victims and fear for their gigantic USD reserves and the danger of no longer being able to send them through the SWIFT system.

The countermeasures are already being implemented by the East at lightning speed. Not only Russia, but also giants like China and India are increasingly trading commodities in their own currencies – away from the Petrodollar and the Euro. Within a few months, this has led to the Rouble becoming an increasingly important commodity trading currency and, as a consequence, the best performing currency in 2022. The Euro, on the other hand, has fallen from 90 to below 60 against the Rouble since February.

Confidence in the US dollar is thus fading not only because of devaluation through money printing, but also because of security concerns in the East.

Large gold purchases

Another circumstance that is a more than tangible indication of the East’s desire to break the hegemony of the West is the large gold purchases in the East – and this has been going on for decades. The official figures – for instance from China (2,000 tonnes)

“In the last quarter alone, central banks bought 400 tonnes of gold, three times more than in Q3 2021.”

and Russia (2,300 tonnes) – only concern the reserves of the central banks. Reliable estimates assume that China holds a total of between 20’000 and 30’000 tonnes and Russia around 12’000 tonnes of gold.

In the last quarter alone, central banks bought 400 tonnes of gold, three times more than in Q3 2021. Turkey was the number one buyer with 31 tonnes. In addition, Uzbekistan, Kazakhstan, Quatar and Mozambique are known buyers. How much Russia and China have added is not known. What is clear, however, is that many countries are constantly increasing the proportion of gold in their currency reserves.

So we can conclude that, on the one hand, the East is increasingly using its local national currencies as trade currencies to avoid the US dollar and, on the other hand, gold has been accumulated in the East for years. So much for facts.

The way away from the US dollar

From this point on, due to the secrecy of the East, it becomes difficult to ascertain exactly which path the East will take to accomplish the goal of a multipolar world. A great deal is being written on this subject and certain tendencies can be discerned. These are briefly described below. Many countries will participate, but all of them will represent their particular interests; however, it is foreseeable that major powers such as China and India and large commodity producers such as Russia, Saudi Arabia and Iran will have a great influence on the outcome.

The use of national currencies and gold as trading currencies could be a first step away from US dollar hegemony, with other currencies being used in this first step, but the price reference will still be the US dollar. This has already happened to a considerable extent with regard to the Rouble. The Rouble changed from a niche currency to an established trading currency this year, which also explains its strength in the market.

In a second step, the USD price reference could disappear. However, the yuan will not be able to replace the US dollar easily, as it is not freely convertible and yuan hegemony is not the goal. Gold and other commodities could offer themselves as a price reference. That gold will play an important role is already evident from the fact that many central banks in the BRICS or BRICS+ countries are stocking up on gold.

The third step would then be the creation of a new – possibly digital – currency. This creation is being discussed openly. It is not taking place behind closed doors, but the Western media are simply not reporting on it. Which countries, apart from those already mentioned above, will initially participate is also still unclear, although it will probably be the countries around BRICS and SCO that will introduce a common currency.

This new currency will be money, backed by real values. This will be the crucial difference to the Western fiat currency system, a system without intrinsic value.

The East will call this a declaration of independence from the West. However, one does not have to be an augur to realise already that the West will try to prevent this by every means possible. Never in the history of the world have the hitherto powerful voluntarily given up the sceptre. Exciting times are ahead.

7 thoughts on “The unstoppable rise of the East”