BRICS – Series – Part 2

Part 2 – of our series: A look back explains today’s system, its origins and abuses that led to BRICS & Co.

Peter Hanseler

Introduction

After we merely presented facts and figures about BRICS and other organizations in their sphere in the first part “BRICS – Series – Part 1“, the aim of this second part is to discuss why it is exactly now that the Global South is striving to break free from the shackles of the West.

To answer this question, a look back is not only helpful, but absolutely imperative.

We flash back to the end of World War II and discuss the distribution of power at that time, which led to the Bretton Woods system in 1944 and then to the petrodollar in 1971.

We illuminate the abundance of power, which the USA received thereby, further how this abundance of power was abused, which finally led to the emergence of BRICS & Co.

In the upcoming third part, we will then show whether and to what extent BRICS & Co. could prevail.

Historical review

Introduction

President Giscard d’Estaing described the advantage the Americans had because of the Petrodollar – which made the USD the global reserve currency – as being exorbitant.

How is this to be understood and was the French president right?

The Bretton Woods System

In 1944, the Americans reached the pinnacle of their power. They dominated the war effort with the Russians, possessed 22,000 tons of gold, and American industry produced 70% of the world’s manufactured goods. Total dominance looks like this:

Military dominance

Industrial dominance

Gold – he who has the gold makes the rules

Against such an overwhelming power, based on the three pillars of military, industry and gold, the entire rest of the world – whether friend or foe – had no chance.

The Bretton Woods system was thus an emanation of absolute U.S. power and not – as portrayed in the history books – a system negotiated by the victorious powers of World War II to protect the entire West in an atmosphere of friendly partnership.

Bretton Woods also sealed the demise of the British Empire by allowing the Americans absolute power through the pegging of the remaining currencies to the U.S. dollar and its peg to gold.

The English, for example, under John Maynard Keynes, proposed a system that involved the introduction of the Bancor. The Bancor would have been used as an international unit of account to which participating currencies would have been pegged. The value of the Bancor itself was to be backed by gold. The English failed – the Americans prevailed.

The system proposed by John Maynard Keynes, in which a gold-backed Bancor would have served as the unit of account, would have been a fair system, giving a fairer chance to countries with merit and leading to a multipolar world – at least in monetary terms.

It is quite possible that BRICS & Co. will seek a Bancor-like solution – a path to multipolarity.

Great responsibility for the USA

However, the Bretton Woods system gave all members the right to exchange the USD they held for physical gold at USD 35 per ounce at any time.

Consequently, the system forced the Americans to behave in a monetary way that all member countries had confidence in the U.S. dollar and that it was indeed as good as gold.

The USA without fiscal discipline

The Americans, however, as a world power and hegemon, did not care one iota about the interests of their partners and, starting in the 1960s, printed more and more U.S. dollars to finance the Vietnam War and the Great Society project.

Both the costs of the Vietnam War as well as the Great Society Project, the largest social program of the USA up to that time, whose main goal was to completely eliminate poverty and racial injustice, got completely out of hand.

“The Americans’ vast hoard of gold melted away like butter in the sun.”

France wants gold for its US dollars

The French were the first to realize that the USD was losing value due to American money printing and to exercise their contractual right to exchange their dollars for gold. Others followed suit.

The Americans’ huge gold hoard melted away like butter in the sun. While the USA had more than 22,000 tons of gold at the end of the war, it was only a little over 8,000 tons in 1971.

The USA pulls the trigger and breaks the treaty

On August 15, 1971, all major television stations in the U.S. interrupted their Sunday afternoon programming and President Nixon addressed the nation.

He claimed that the speculators were waging an all-out war against the U.S. dollar and that he had thus ordered the U.S. dollar to be defended against the speculators. He had ordered that the convertibility of the U.S. dollar into gold be temporarily suspended.

This sounded patriotic, but it was a complete lie. The “speculators” Nixon decried were actually members of the Bretton Woods system who had realized that the Americans had ripped them off and were merely exercising their contractual right to exchange worthless U.S. dollars for gold.

Nixon thus committed nothing more than breach of contract. The members of Bretton Woods were ripped off and left sitting on their paper dollars.

“They had not reckoned with the brilliant Henry Kissinger.”

Henry Kissinger invents the petrodollar

The deceived members of Bretton Woods decided not to hand over a declaration of war to the Americans, but – with exceptions – made a fist in the pocket. They probably believed that the Americans had dug their own grave by breaking the treaty.

They had not reckoned with the brilliant Henry Kissinger. The latter was sent by Richard Nixon on “Mission Impossible” to save the U.S. dollar.

Kissinger convinced Saudi King Faisal to sell his oil exclusively in U.S. dollars and to invest the proceeds in American government securities. In return, the brilliant Kissinger promised Faisal military protection.

“Mission accomplished: The Petrodollar was born.”

Other countries and commodities followed. Like Houdini, Kissinger freed the U.S. from a dire situation by making the impossible possible. Mission accomplished: The Petrodollar was born.

Exorbitant economic privilege

Now, if almost the entire world uses a single currency – the U.S. dollar – for almost all trade activities, all countries are forced to hold this currency in reserve to pay their bills.

These countries do not hold the reserves in cash, but invest them in American government securities to earn a return on their reserves. In this way, the Americans cemented the nimbus of being the largest bond market.

It should be noted here that the U.S. dollar is a product like any other, whose price is subject to the law of supply and demand.

The U.S. dollar is bought not because it is a good investment or to buy American products, but because U.S. dollars are needed to buy any product. This unjustifiably strengthens the price of the U.S. dollar.

Why unjustifiably? – Other countries need to produce something worth buying that will hold up in the world market to keep their currencies valuable – the U.S. does not.

If now the whole world has to hold US dollars and holds them in American government securities, the American government finances itself almost for free. Thus, the price of American bonds does not depend on the strength of the American economy, but is based on compulsory buying.

Complete abuse of the economic privilege

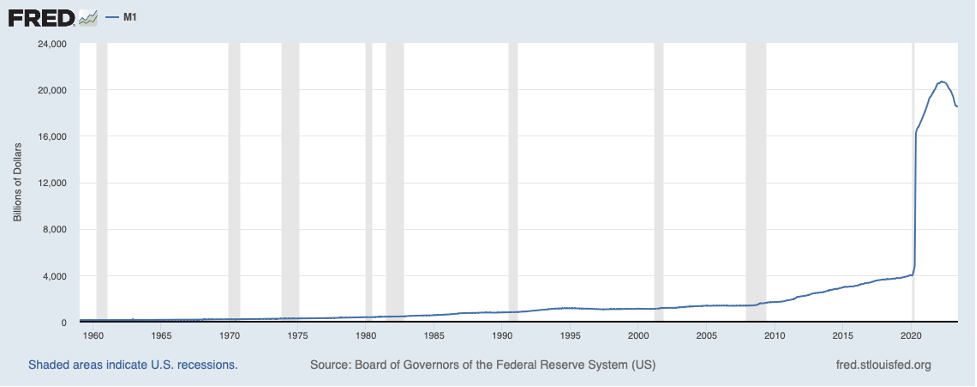

The USA could thus afford everything for over 50 years, because the bills were paid by others.

Imagine a big mouth who goes shopping with a credit card without limit, has a big mouth, buys everything he wants and never pays the credit card bill, but owes the money to those who sell him the goods without ever getting paid.

You don’t believe me? – Then take a look at the unpaid bills of the USA since 1959.

So now we know how, for over 50 years, the U.S. has cultivated a lifestyle at the expense of others that in no way correlates with the performance of its economy, but is based only on the compulsion of the rest of the world to hold U.S. dollars.

Pulling out ends fatally

When it came to maintaining its privilege, the U.S. showed little squeamishness if anyone dared to break away from the dollar regime.

In recent history, two examples may be cited. We may all remember the second Iraq war, when it was pretended that Saddam Hussein had weapons of mass destruction and that this put the USA in danger. Despite a clear report from the UN that there were no weapons of mass destruction or even a single hint that they existed, the Americans attacked Iraq anyway in order to rid the world of Saddam Hussein and bring peace and freedom to the Iraqis. A big lie.

“The reason for the Iraq war was quite different: the U.S. dollar”

Weapons of mass destruction were not to be found, half a million civilians were killed – their relatives were certainly thrilled about this kind of democratic movement that the USA forced on them.

The reason for the Iraq war was quite different: the U.S. dollar.

Saddam Hussein – we don’t need to dwell on his qualities as a human being here – wanted to sell his oil in Euros as well. That was his death sentence. Anyone who claims otherwise is either ill-informed, naive or lying. The facts are on the table.

President Gaddafi led Libya with a strong hand for decades. He made Libya the richest country in Africa with an excellent infrastructure. Whether Colonel Gaddafi was a do-gooder or not is also not a topic of this discussion.

Gaddafi also had a plan to get away from the U.S. dollar: He wanted to create the Gold Dinar to free Africa from the shackles of the Petrodollar. This, too, did not go over well with the Americans. The result was a dead Gaddafi and a completely destroyed country.

The US dollar as a weapon

Under the Petrodollar system, all countries that want to participate in world trade are forced to hold U.S. dollars and to make or receive payments with them.

It is important to know that only the U.S. Federal Reserve can actually hold U.S. dollars. Every bank in the world that offers US dollar accounts ultimately only has an accounting entry for a US dollar amount and a contractual entitlement to the US central bank. This also explains that any payment made in US dollars is made in the US.

Thus, the Americans can single-handedly cut off any party – be it a country or a person – from the U.S. dollar or freeze or seize a party’s U.S. dollars.

The U.S. has been doing this systematically since World War II with countries it wants to harass, punish, or eliminate economically. The USA sanctions Cuba for over 60 years or Iran for over 40 years.

This is justified by the USA with flimsiest arguments like communism, terrorism, war crimes etc. Whether the accusations are true or not, is completely irrelevant, because no judge accepts the case, because these sit all in the USA.

When the Americans impose such sanctions, they regularly threaten any party that does business with the sanctioned party with sanctions as well. These are the so-called secondary sanctions. Since most international business was done in US dollars, the companies – banks, commodity buyers, industrial suppliers – had no choice: the legal argument was power.

Overstretching the bow

Shortly after the start of Russia’s invasion of Ukraine, the West, led by the U.S., not only slapped Russia with a flurry of sanctions that has no equal in history, but also froze the foreign currency reserves of the Russian Central Bank. Shortly thereafter, discussions began as to what the West intended to do with the funds. After the freeze, the robbery is now being discussed.

Our blog pointed out several times that this action of the Western central banks crossed a red line, which will have severe consequences for the West.

BRICS strengthens

As a result, many countries of the Global South – above all China and India as economic giants – completely lost confidence in the hegemon and its vassals.

It is clear to every geopolitician that the West’s major offensive against Russia is only a first step towards preventing China from gaining complete strength. The West is afraid that China will seek to replace the United States as hegemon. However, in my opinion, this is a misjudgment. Although China will probably become the strongest country in the world, it seems to me that the Chinese are not striving for unipolar leadership, but are interested in a multipolar world.

This is the only way to explain the fact that China and Russia are jointly interested in strengthening the BRICS world with their partner organizations.

Diplomatic masterstrokes in the Middle East

Within a very short time, China and Russia achieved two diplomatic masterpieces. They managed to achieve peace between the two belligerents Saudi Arabia and Iran. This was the ticket for these two countries to join BRICS and SCO – it succeeded.

The second stroke was that the Russians managed to achieve peace between Saudi Arabia and Syria, which also led to Syria being readmitted to the Arab League.

Loss of U.S. influence in the Middle East

These diplomatic masterstrokes should not be underestimated. Within a few months, the geopolitical situation in the Middle East has changed completely – much to the annoyance of the USA.

Two of the world’s largest oil and natural gas producers have reconciled, thus wresting the instrument of divide et impera from the Americans. It will be virtually impossible for the Americans to set the Middle East ablaze once again because of the current interests of the major powers in the Middle East.

BRICS Summit, August 22-24, Durban, South Africa

Our readers are now one step further in understanding the scope of the BRICS summit. The coverage of this historic meeting by the Western press is more than pitoyable: silence (NZZ) or arrogant chatter (FT).

In the third part of our series, we will discuss the possibilities BRICS & Co. have to achieve their goals, taking every effort to distinguish facts from wishful thinking.

Conclusion

We have seen that a nation with such a great power as the USA at the end of the Second World War forced the rest of the world into a completely unfair and hegemonically controlled corset and then cold-bloodedly cheated its partners, whom they call friends (Bretton Woods).

After the failure of this system, which nota bene failed because of the dishonesty of the USA, the USA managed to launch a second system, which was even more unfair than the first one (Petrodollar).

Further, we have seen that the U.S. defends the petrodollar by all means and does not shy away from murdering millions of people to maintain its system.

These facts must be kept in mind by BRICS & Co. if they want to bring down the Petrodollar and introduce a multipolar system.

The USA as a declining world power should therefore under no circumstances be underestimated – not only in terms of the means they are willing to use, but also in terms of their ingenuity to conjure up solutions out of a hat in a situation that seems hopeless – Henry Kissinger sends his regards.

11 thoughts on “BRICS – Series – Part 2”